Projects

January was very quiet month in terms of side projects. It was somewhat expected as same pattern repeats itself every year. In total I completed only 1 project (-6 compared to previous month) and did some minor maintenance work that does not as project but still generated little revenue.

| Month | Projects | Change |

|---|---|---|

| August | 4 | +0 |

| Septmeber | 5 | +1 |

| October | 2 | -3 |

| November | 4 | +2 |

| December | 7 | +3 |

| January | 1 | -6 |

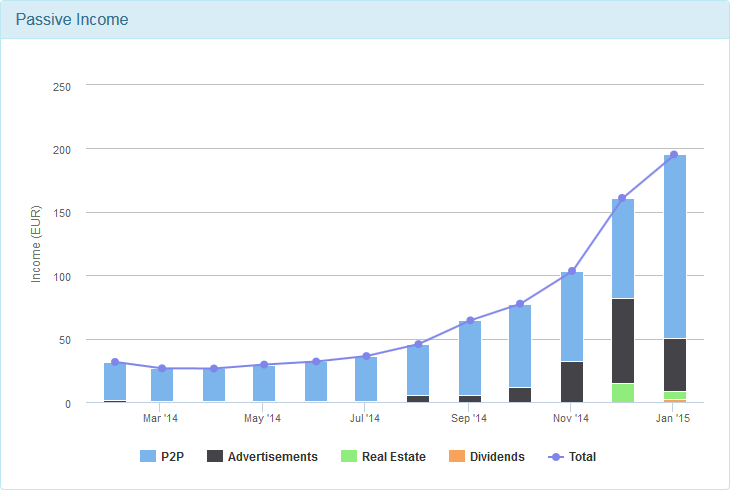

Passive Income

In summary January was satisfying as the income increased reasonably (+34.21€) to total of 195.19€. The interest income part was 145.06€ (+65.73€), advertisement income correspondingly 41.29€ (-25.51€), income from real estate lending sites 6.73€ (-8.12€) and income from dividends 2.11€ (+2.11€).

Advertisements income decreased as December is the prime month thanks to Christmas poems searches. Expect 20€ to 30€ from advertisements throughout the year. I also got my first dividends from SPY. This time I was taxed by 30%. Next week I will ask from LHV if I can fill a form to pay 15% of the tax in the future.

Investments

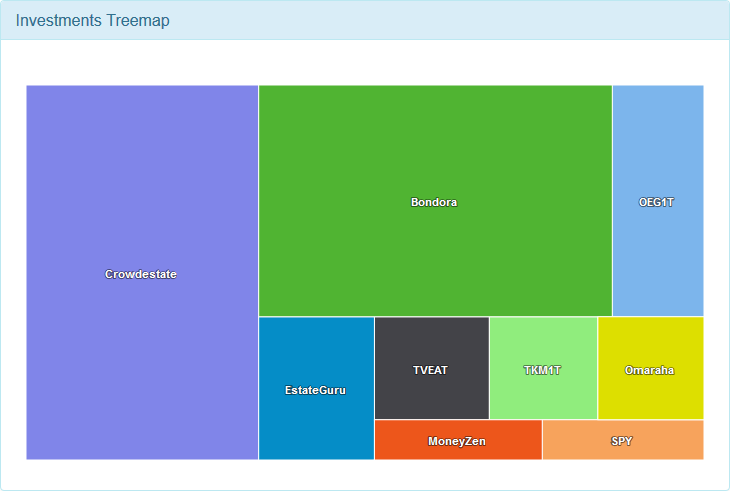

In January I invested first time into Omaraha (mostly due do Bondora incapability dealing with new portfolio manager). Regardless of that I transfered little more money to Bondora but I used most of the money to buy loans from secondary market. My portfolio manager currently only invests into AA, A and B rating loans.

I also participated in 2 real estate investments (1 CorwdEstate and 1 EstateGuru). Bellow you can see my investments allocation. I would like to increase my stock investments this year but the prices seem to little high at the moment but I have not analyzed the situation thoroughly yet. SPY seems interesting option however I do not like USD/EUR exchange rate as I have not studied it’s dynamics yet.

See more

Updated Financial Independence report and Savings Rate report

Hi Taavi, just out of curiosity, are you investing on SPY via ETFs like VTI or IVV? Btw thanks for sharing

Hi Luis. I am investing into this (http://finance.yahoo.com/q?s=SPY) instrument. It is itself an ETF. It seems that VTI and IVV are also ETF’s so they all should be same type on instruments.

Yes, SPY, VTI and IVV are all ETFs tracking S&P 500. I asked because LHV offers IVV and VTI in their Growth Account but not SPY.

I have not information about that but I have learned that IVV at least is almost the same, just it is not as big as SPY but it’s not so important when you invest longterm. However I might drop my idea to invest into these ETF’s at the moment. I made some calculations and I would need to invest 10k-20k into US stock to minimize the monthly fees of brokers or use some other broker than LHV. Or else you spend 1-20% of the portfolio value to fees per year, depends of the portfolio size and account (Trader, Broker, Bank).

I’m impressed, your passive income is growing very quickly! (The joys of working in IT!)

Thanks! I took another look into Bondora money flow charts and seems that January had quite high expected interest income compared to December and following months. Thanks to that I had better growth 🙂 But yes IT helps however I have spent countless of hours to master it, since the beginning on highschool actually. My first project: http://web.archive.org/web/20060429160327/http://www.maaleht.ee/?page=&grupp=artikkel&artikkel=5555 😀

Hah, super awesome! And media coverage, not many young people can achieve that!

Topeltmakustamise avalduse saad teha LHV interneti pangast. Info ja seaded > Lepingud > W-8BEN /sõlmin lepingu/

Jah, tegin ära just täna, aga küsimus on selles, kas see Brokeri puhul ka kehtib või ainult Trader ja LHV netipanga kaudu tehtud tegingute korral. Pole veel enda kliendihaldurilt vastust saanud, online abi ütles, et brokeris ei kehti.