Yesterday Kristi wrote that there is panic at the stock market, along with massive amount other articles about the correction. As Kristi said that this is probably an emotional reaction to the China market crash. I am more numbers person so I read few articles that were not fully emotional based but analyzed the numbers and statistics. I wanted to share you few findings and pictures I found.

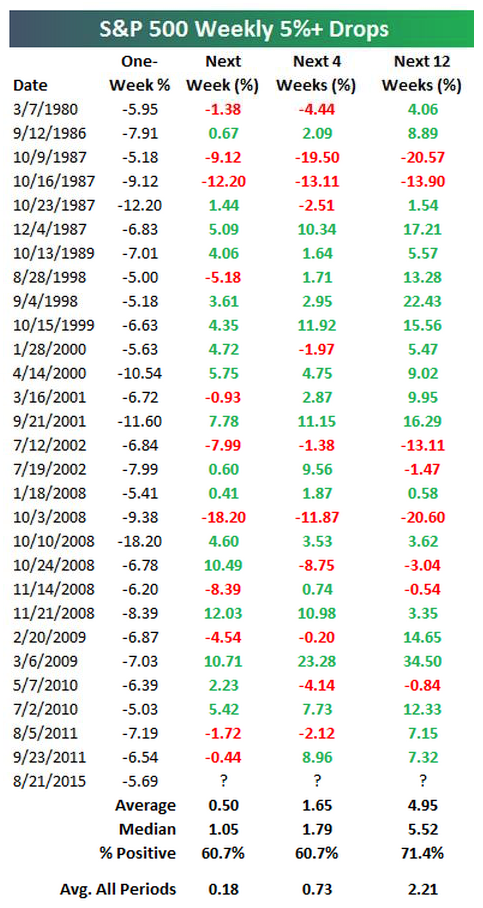

What Usually Happens to Markets After the S&P 500 Drops 5 Percent in a Week?

Is the selloff over?

According to MarketWatch article there is a 0% chance that the selloff is over. There have been 211 corrections in the S&P 500 of 5% or greater since 1927. They stated that once the price goes down more than 5% you end up going down further, more often than not. The mean decline has bee 12.11%. According to this information there is great chance that the market can drop a little more as it down by about 5.8% this week and 7.8% from its record close.

What to do?

Keep calm and stick to your investment plan. If the price will drop more and you have already planned to buy the instrument, then it is a good time to do it a bit earlier. If you have extra cash and you are waiting for the next crash then it is most probably too early to buy larger amounts. Another strategy that I personally like is to buy some when the price is down about 10%, then 15% and so on because it is almost impossible to time the market.