Sorry for so late, short and laconic overview this time. I have been quite busy and I have limited my online time to only necessary duties. There have been not many interesting things in terms of investing. I made 1 ETF purchase to average down the cost. I do not plan to add new money to P2P sites at the moment. I am focused more on stock market and will make some moves when prices drop enough.

I got some more interests from Crowdestate (don’t plan to add new money at the moment) and also got first payment from LHV bonds. I will close my private Bondora portfolio (transferring all interests and principal payments out, but not selling the loans), I also decided to close my Moneyzen private and business accounts (not investing in new loans), as the money invested there is low and therefore adds unnecessary overhead.

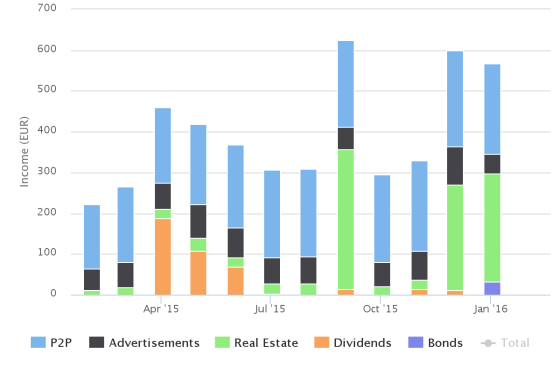

Passive income

My passive income decreased by -30.16€ to total of 568.33€. The P2P loan interest income was 222.55€ (-11.81€), advertisement income correspondingly 48.06€ (-46.28€), income from real estate lending sites 258.78€ (+6.44€), dividend+bonds income 32.50€ (+21.49€). This makes my rolling average passive income rate to expenses 44.47% (+2.43%).

Looking good! Seems you’re rather close to an average of 500€ passive income/month!

More like 300-350, as last larger income was from Crowdestate and those projects are now ended. But, ~500 would be quite nice goal for 2016. Although investing into stocks do not increase it much as the dividend rate is quite low compared to P2P portfolio.