I have to admit that 2015 was a great year in terms of my pursuit to financial freedom. It was first full year where I was able to save money for investments and actually make the investments. At the beginning of 2014 I bought a new home and before that I saved the money for the down payment and therefore did not make any new investments. After the purchase I started to make the investments more seriously and systematically. Now I am here, after about 1 year and 9 months and It feels great!

Disclaimer: As some of the income and investments are on my business account, theoretically ,the net income (active or passive) and some figures are lower as I would have to pay taxes to take that money into use. To make the math simpler I do not take that tax into account! This makes the picture bit better than it is in the reality.

Net worth

What is net worth? From Wikipedia: Net worth is the total assets minus total outside liabilities of an individual or a company. Put another way, net worth is what is owned minus what is owed. In business it is often used in the context of fraudulent law and on the dissolution of the company.

In 2015 the net worth increased by 55.16% (71.15% in 2014), asset value increased by 32,95% (178,26% in 2014) and liabilities decreased by -2.55%. Not much to say, the numbers are quite satisfactory. The growth will slow down as the assets value increase, because it is much harder to double the value.

Income

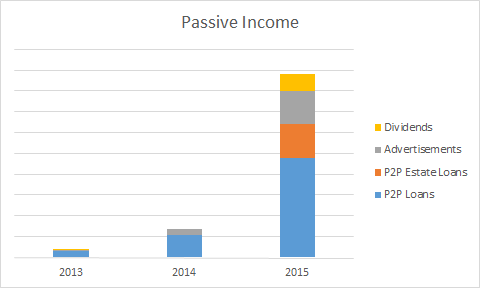

Active income increased by 16.99% (32.29% in 2014) and passive income increased by 557.16% (270.17% in 2014). The passive income % of expenses was 42%, that means that my passive income could theoretically cover almost half of my expenses.

Passive income

Passive income increased by 558.16% (270.17% in 2014). Income from P2P loans increased by 354.37% (239.35% in 2014), income from P2P Estate loans 5361.8%, income from advertisements 518.75% (1967% in 2014).

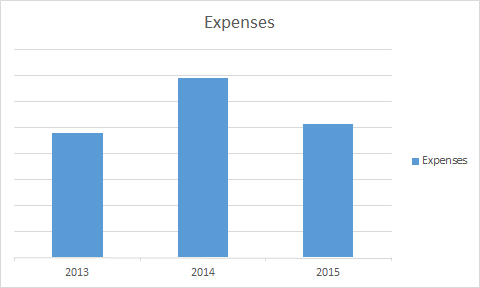

Expenses

In 2015 I managed to reduce my expenses by -25.82% (+44.19% in 2014). In 2014 the expenses were quite high because when I bough new home there were different expenses (such as contract fees, legal fees, taxes, new furniture and repairs). One of my 2015 goals was to reduce my expenses by 10%, but I managed to do even better.

The saving rate for 2015 was 75% (it means that 25% of my income was expended and 75% was saved and some of invested). My goal for 2015 was 55% and I managed to beat this goal also.