And now it is time for my March monthly update. It was another good month, better than previous month mainly due to another Crowdestate interest payment. Other portfolios also generated higher income than in February (one exception was lower dividend income).

In March I increased my Omaraha portfolio due to the fact that Moneyzen did not get approval in time and therefore investing there is paused at the moment. I plan to gradually quit from Moneyzen and also from Estateguru and invest that money to Omaraha and Mintos. Why? It takes more time to manage large number of portfolios.

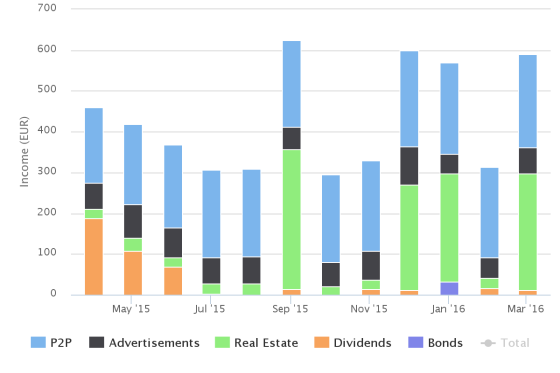

Passive income

My passive income increased by 276.79€ to total of 589.49€. The P2P loan interest income was 229.01€ (+8.08€) , advertisement income correspondingly 63.67€ (+11.96€), income from real estate lending sites 285.2€ (+260.75€), dividend+bonds income 11.61€ (-4€). This makes my rolling average passive income rate to expenses 46.55% (+0.38%).

Palju P2P laenudes raha keereleb, et selline summa tuleb iga kuu? Ja mida see reklaami sissetulek endast kujutab?

Täpset numbrit ma ei taha avaldada, aga keskmine tootlus (Bondora, Mintos, Omaraha, Crowdestate, Estateguru, Investly kokku) on kuskil 17% juures. Selle põhjal võid teha ligikaudse arvutuse.