Intro

September was quite interesting month as first Crowdestate project finished and interest was paid out. Thanks to this it was a record month of passive income. I also attended to some great events – Pub meeting with fellow investors (there were about 12 other investors, some beginners other experienced investors. We had interesting talks with each other about experiences and opinions related to investing and passive income) and Investly investors night (read more about from Tauri blog and Kristi blog).

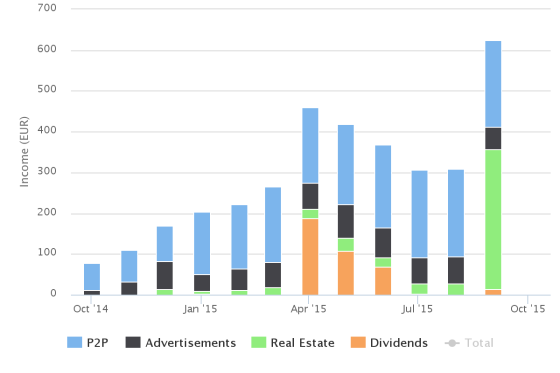

Passive income

It was record month thanks to Crowdestate “Kesk tee 17” project. I also got first dividends from NOV$ and EXSA$. Bondora interest income decreased along with income from advertisements. I also decided that starting from October I will not reinvest Bondora principal nor interest anymore. I will take it out from Bondora and invest it into other P2P lending sites. I don’t like Bondora’s new course – they don’t think about small investors and nothing is clear at the moment. For example Omaraha offers a much higher return on investment at the same risk and Mintos loans have lower risk (due to collateral).

My passive income increased by +316.49€ to total of 624.57€. The P2P loan interest income was 211.84€ (-2.58€), advertisement income correspondingly 55.38€ (-11.07€), income from real estate lending sites 344.62€ (+318.04€), dividend income 12.73€. This makes my rolling average passive income rate to expenses 32.62% (+9.61%).

Investments

It was somewhat active month in the sense of new investments compared to previous months. I gave out one new loan through Estateguru and bought 2 different dividend stocks from the US market. Also, all interests and principal from Bondora, Omaraha, Mintos, Moneyzen were reinvested.

- Estateguru “Uue-Kastani Villa” project failed and the money was returned. I used the money to invest into “Niguliste 8” project. The interest is not very high, however the collateral is solid and the lender seems to have a good reputation (according to Google). There were some other projects also available to invest, but they did not seem very attractive and I am limiting my social lending portfolio size at the moment.

- I bought 11 CAT$, after the price dropped over 10%. The dividend yield should be near 4.7%.

- I bought also 15 OHI$, after the price dropped to 33$. The dividend yield should be near 6.3%.

Nice read and impressive numbers! How long have you been investing?

Hi! Thank you! About 1 year and 9-10 months.