Passive income

Last month had quite an average passive income compared to previous months (when excluding irregular incomes such as Crowdestate Kesktee project interests and Estonian dividends). Peer to peer lending income has stayed somewhat the same, having small standard deviation. They have not grown much, mostly due to that I have not added any new money for at least 5 months now. Theoretically interest should increase anyway, thanks to compounding effect, but it has not much.

When looking portals separately, then Omaraha interest is growing evidently, but Bondora is fluctuating. I have not investigated it further yet, but my best perfection is that the mean of interest has decreased or there are more overdue loans. I did not analyze other portals as the invested amount there is significantly lower and therefore high standard deviation is expected at the moment due to random variables.

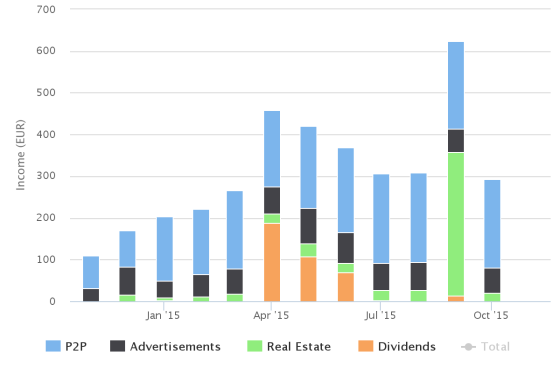

My passive income decreased by -330.5€ to total of 294.07€. The P2P loan interest income was 213.12€ (+1.28€), advertisement income correspondingly 60.34€ (+4.96€), income from real estate lending sites 20.61€ (-324.01€), dividend income 0€ (–12.73€). This makes my rolling average passive income rate to expenses 34.48% (+1.86%).

Investments

- Firstly, I invested into Crowdestate “Kotzebue 14” project – I like the location. I think they are likely to sell the apartments at that location. 8 of the apartments are reserved already that indicates that there should be at least some interest. For example “Sipelga 3” project was having a hard time to find reservations in the beginning of the project, but now, as the building is almost finished from outside, there are only 24% of the apartments not sold or not booked.

- I also transferred some money to Omaraha, but as I stopped automatic investments, in Bondora I will transfer all excess money out, unless I find some good (cheap and low risk high interest) opportunities from second market.

- Bought 2 LHV Bond pieces.

Growing very quickly there! Joys of working in IT 😉

Thanks Kristi. I must say that it is thanks to mostly freelance projects.

It is easy to grow the portfolio when the economy is doing well, we will see if the investments decisions are right when the economy crashes 🙂

Great progress, Taavi. Your P2P income has grown a lot year over year. Do you plan to invest more with Omaraha or look at other dividend producing assets going forward?

Hi! Thank you, for your comment!

At the moment I would like to increase other investments (especially dividend stock), because I want to reduce my portfolio risk as the P2P makes significant portion of the portfolio. However stock prices seem to be bit overvalued therefore I am not rushing and analyzing the opportunities.