Hi there! Another month has passed and summer warmth has not yet arrived in Estonia. It is time to give my June portfolio update. If someone is not yet noticed, half of the 2015 has passed (too fast!), therefore I plan to soon write another post about my half year goal progress.

What happened in June?

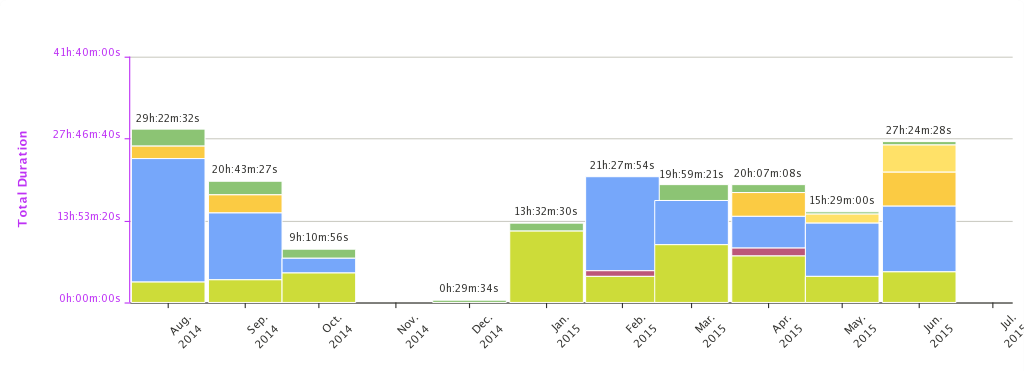

Nothing super interesting happened, but it was good month full of different sport activities. I started to use my bicycle when going to work (on sunny days) and I like it. You can look my progress on the chart below.

We Estonians also had our national holidays called “Jaanipäev” and “Eesti võidupüha” and I personally had almost 5 day mini vacation that included grilling and eating. It is a time when a lot of people drink and eat too much. I managed to avoid the first one entirely and the second one was managed also fairly good. The only regret is that I did not do much sport during that 5 day period only some work in our summer home.

BTW. I had an idea that someone should organize “Finatsvabadus” groups “summer days” event. For example, few hours of chatting and grilling meat in the nature. Maybe someone has a good spot/summer home near Tallinn?

Enough of that, back to numbers!

Passive income

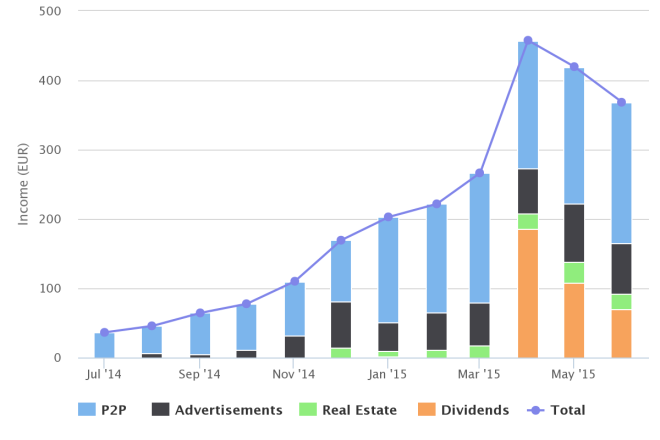

June was again worse than 2 previous months, mostly because lower dividend income, however, this is expected due to the yearly dividend payment policy in the Baltic stock market. When not taking dividends into account, it was still worse than May as the advertisement income has decreased also (people spend less time on-line in summer).My passive income decreased by -51.33€ to total of 368.33€. The P2P loan interest income was 202.88€ (+5.80€), advertisement income correspondingly 73.86€ (-10.21€), income from real estate lending sites 22.29€ (-7.92€), dividend income 69.3€ (-39.00€). This makes my rolling average passive income rate to expenses 16.81% (+1.57%).

Investments

As I have stated before, I do not want to add new money into P2P lending sites at the moment (therefore I did not add any money to any of the P2P sites, but I reinvested all the interests and principal payments). Mostly because I want to balance my portfolio and I am also accumulating money as I think there will be a smaller or a larger correction sooner or later and extra cash is handy when purchasing a cheaper stock or other assets. At the moment my I try to keep 50% of my portfolio in cash. I also have about 28% in not guaranteed loans, 13% in stock and 9% in guaranteed loans.

I made one TVEAT (Tallinna Vesi) purchase thanks to bit lower stock price. My goal is to increase my stock percentage to about 25% of my portfolio (including cash) but I am waiting more reasonable prices while keeping my yearly investment goal (I am 2 months ahead at the moment).